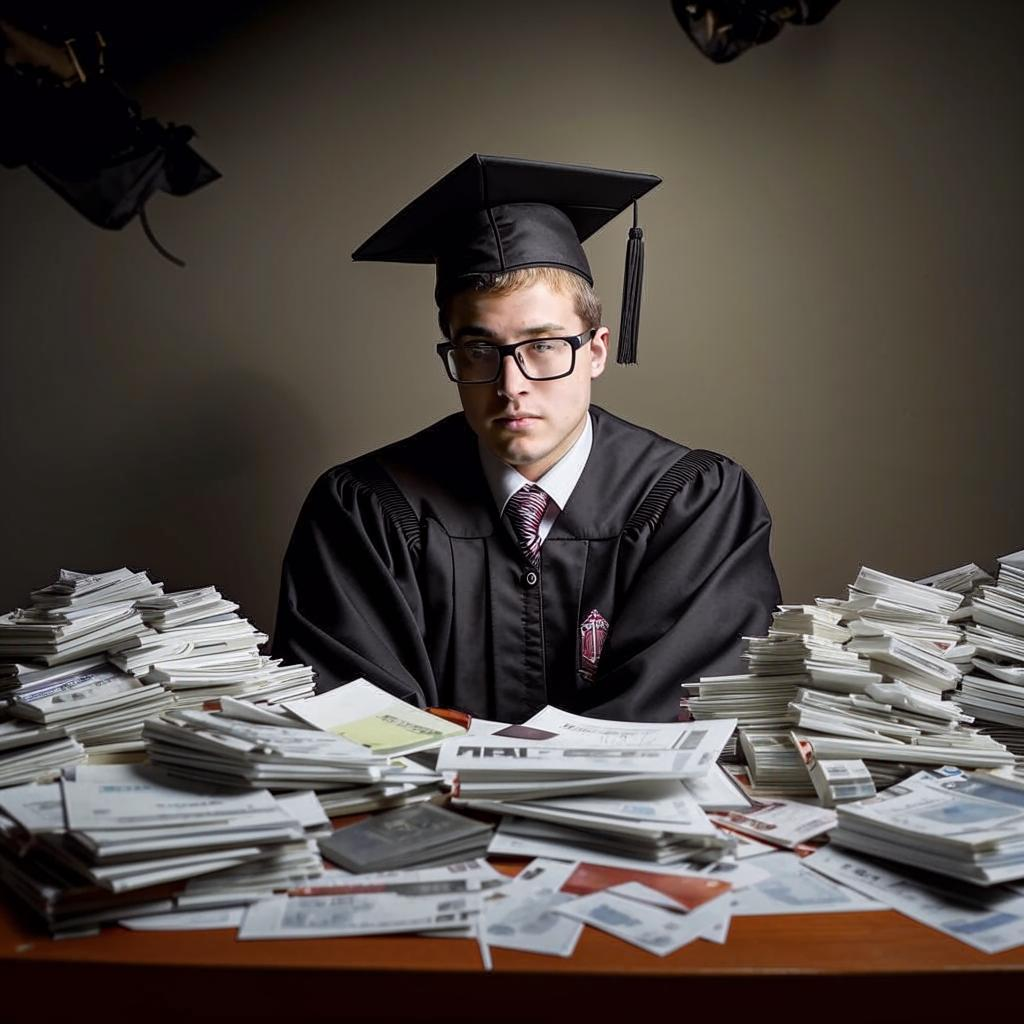

The escalating student loan debt crisis in America is crippling a generation. Rising tuition costs, coupled with stagnant wages after graduation, have created a perfect storm of financial hardship. Millions of young Americans are burdened with crushing debt, hindering their ability to buy homes, start families, and contribute to the economy. The long-term consequences of this crisis are dire, potentially slowing economic growth and widening the wealth gap.

The roots of the problem are complex. State funding for public universities has declined, pushing tuition rates upward. Simultaneously, the value of a college degree in the job market has increased, making higher education a necessity for many, regardless of the cost.

Proposed solutions range from widespread student loan forgiveness to reforms aimed at controlling tuition inflation. Loan forgiveness could provide immediate relief to borrowers, but critics argue it is a temporary fix that does not address the underlying issues. Tuition reform, on the other hand, could prevent future generations from falling into the same debt trap, but it may take years to implement.

The debate over student loan debt is heated, with strong opinions on both sides. However, there is a growing consensus that the current system is unsustainable. Finding a solution that is fair to both borrowers and taxpayers is essential to ensure a brighter future for all Americans. A failure to address this crisis will have lasting repercussions on the nation’s economic and social well-being.